Despite a significant push for universal health coverage through the National Health Insurance Authority (NHIA) Act, many states are failing to fully embrace the mandatory health insurance scheme. The Act, which made health insurance compulsory for all Nigerians in 2022, was a milestone in healthcare reform aimed at addressing the high out-of-pocket costs that have burdened many citizens. However, more than two years after its enactment, enrollment numbers remain disappointing in several states.

Recent data highlights a stark contrast in enrollment figures across the country. States like Delta, Lagos, and Kano have made notable progress, each enrolling over one million residents. In contrast, other states, including Akwa Ibom, Kebbi, Taraba, Abia, Ebonyi, and Zamfara, have less than 200,000 enrollees each, revealing a significant gap in coverage.

Also read Debate Erupts Over Proposed Capital Requirements in Nigerian Reform Insurance Bill

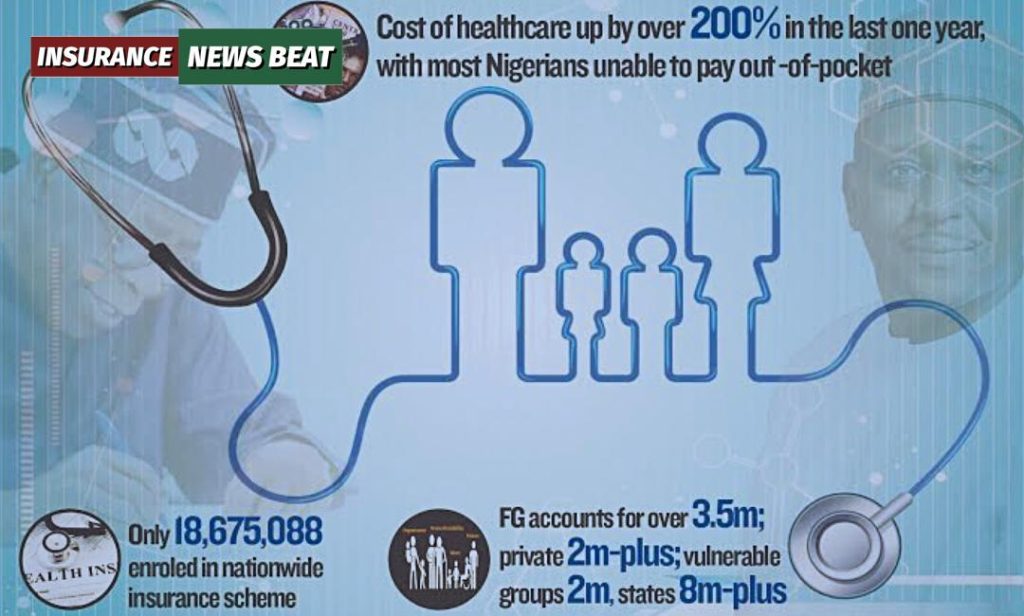

The cost of healthcare in Nigeria has surged by approximately 200% over the past year, with many citizens unable to afford medical expenses out-of-pocket. The World Health Organization (WHO) reports that Nigeria has the highest out-of-pocket health expenditure in West Africa, driving many into poverty due to medical costs.

The NHIA Act, signed into law on May 19, 2022, aimed to address these challenges by making health insurance mandatory and establishing the NHIA as a more effective regulator. The Act also introduced mechanisms to support the poor and vulnerable through various funds.

Also read NDIC Pays 82% of Insured Deposits to Heritage Bank Customers Following License Revocation

Despite these efforts, only about 8.5% of Nigeria’s population, or 18.67 million people, are currently covered by health insurance. This includes enrollees from the formal sector, private sector, vulnerable groups, and state Social Health Insurance schemes. For example, Delta State, with a population of over six million, has enrolled approximately 2.58 million people, while Akwa Ibom State, with over five million residents, has only 128,174 enrollees.

Dr. Leke Oshunnyi, Chairman of the Health and Managed Care Association of Nigeria (HMCAN), criticized the low coverage rates, emphasizing that health insurance is now a legal requirement for all Nigerians. He noted that the transition to mandatory coverage has faced logistical challenges, including changes in leadership at the NHIA and the need for extensive advocacy to increase enrollment.

NHIA Director General, Dr. Kelechi Ohiri, acknowledged the challenges but emphasized ongoing efforts to collaborate with relevant institutions and revise guidelines to enhance enforcement. He highlighted initiatives like the Basic Healthcare Provision Fund to support the poor and vulnerable.

Also read Concerns Raised Over Unethical Practices in the Nigerian Insurance Industry

In Nasarawa State, Executive Secretary Dr. Yahaya Ubam reported a successful start with about 245,000 enrollees, aiming for 500,000 by 2027. Similarly, the Federal Capital Territory (FCT) has enrolled 175,438 residents, with efforts to increase coverage through programs like the “Adopt and Enrol Campaign,” which seeks corporate sponsorship for the uninsured.

Overall, while progress has been made in some areas, significant work remains to achieve universal health coverage and address the barriers preventing widespread enrollment in Nigeria’s health insurance scheme.